Small Business Health Insurance In Houston

Our team brings deep experience in health insurance for all aspects for small and medium-sized businesses.

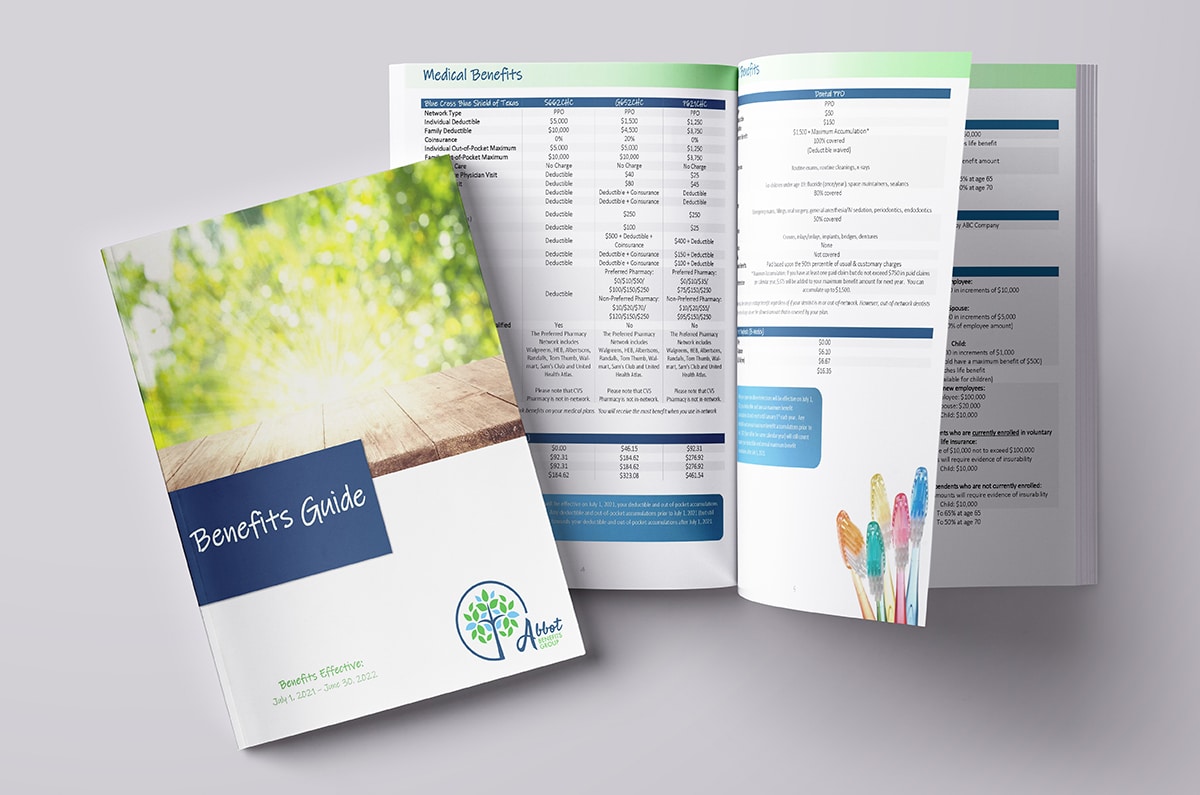

Not sure what kind of Houston’s small business health insurance is right for you? Abbot Benefits Group health insurance consultants can help!

The following options; fully insured plan, level-funded plan, private exchange, self-funded plan & medical captives, are some of the most common ways we help our clients ensure that their medical plans are built for maximum benefits.

Fully Insured Plans

These are the most traditional – and most simple –small business health insurance plans in Houston. Employers pay a fixed monthly premium to the health insurance company. This allows for all liability for paying claims to be transferred to the health insurance companies.

For small businesses (fewer than 50 employees), health insurance plans are best for employer groups with higher risk/higher claims. Premiums are based solely on the age and the location of the business, and do not take into consideration additional factors such as claims history, health conditions, or the overall risk of the group.

For medium-sized businesses (more than 50 employees), these plans are best for employers that prefer a fixed monthly budget. They can also be beneficial for employers that may have more risk or claim frequency within their enrolled population.

Level-Funded Plans

Level-funded plans have become increasingly popular for small businesses. These plans are housed on a self-funded platform but are designed to look and feel like a fully insured plan, with a fixed monthly cost and no additional financial liability to the employer. A level-funded small business health insurance plan is best for a group with below-average claims or risk.

The cost of a level-funded plan is often much more attractive, and employers can get refunded at year-end if claims are low. However, level-funded plans require employers to conduct additional ACA reporting. An additional consideration is that Texas State Continuation does not apply to level-funded plans. Since COBRA does not apply to employers with fewer than 20 employees, an employer with a level-funded plan and fewer than 20 employees would not have an option for terminated employees to continue coverage once their employment or eligibility ends.

Abbot Benefits Group is committed to supporting our clients with their level-funded plans. As a result, we handle the burden of ACA reporting at the end of the year. Employers are only required to review for accuracy and send when approved. We also help with filing the Patient Centered Outcomes Research Institute (PCORI) paperwork, guiding employers to help them properly fill out IRS form 720.

Private Exchanges

In a private exchange, employers are put on a level-funded plan – but the claims fund is pooled between all employers on the exchange. In a small group of 10 to 20 employees, claims will be combined with all other groups in the pool.

This creates a much more stable renewal environment for smaller groups, as the exchange performs as a large group (for example, as 400 employees) rather than a small group. Abbot Benefits Group is proud to offer this emerging medical benefits plan for employees of small businesses through our partnership with Benefit Concepts, Inc.

Self-Funded Plans

Self-funded plans are most common in employers with more than 100 employees. In a self-funded plan, the employer is financially liable to pay claims until they reach the stop loss limits. These limits typically fall into one of the following categories:

- Specific stop loss insurance, which covers all claims for an individual member after they exceed a threshold (such as $25,000 or $40,000).

- Aggregate stop loss insurance, which pays for claims once the entire group has exceeded a threshold (typically 125% of total expected claims, which are determined upon quoting).

Self-funded plans are best for group medical insurance with a good claims history, and for employers that are proactively trying to lower claims costs, such as by implementing wellness programs or various benefit design considerations. Costs to the employer may fluctuate, and additional administrative oversight will be required (weekly reports, payments, etc.) with a self-funded plan.

However, employers that are the right fit can save a significant amount of money over the long run. Similar to the stock market, the returns from the good years could easily outweigh the costs from the bad years.

Medical Captives

This is a unique option for stop loss insurance for employers on a self-funded plan. Rather than pay a stop loss company to provide insurance, the employer joins a “captive” with other participating employers to create – and own – their own stop loss company.

Since employers own the captive, they share in the stop loss insurance profits and receive a dividend after the policy year ends. They also enjoy greater control and flexibility; but just as employers can share in the profits, medical captives come with equal risk that employers could share in the losses.

Let Abbot Benefits Group Create the Right Health Insurance Plan for Your Small Business in Houston

There is a lot to consider when deciding on your group health insurance benefits for small businesses – and having an expert advisor in your corner can make all the difference. Get in touch with group medical insurance agents experts at Abbot Benefits Group today to create the perfect benefits plan for your needs. Our health insurance agents will consult with you to determine which products may be most suitable for your small business and your employees, including:

- Group Health Insurance and Prescription Drug coverage

- Fully Insured, Level Funded, and Self Funded plans

- Private Exchange (employers join together into common claims pool)

- Medical Captives

- Health Savings Account (HSA) Qualified Plans

- Health Reimbursement Arrangements (HRAs)

- PPO, POS, EPO, & HMO networks

- Reference-Based Pricing

- Layered Networks (PPO and Reference-Based Pricing)

- Wellness Plans

See the difference Abbot Benefits Group can make in your business!

Call Today: 281-374-7577

Frequently Asked Questions

A small business must employ a minimum of two full-time employees to be eligilbe for a small group health insurance plan in Houston, Texas. This can include owners of the business as well. Contact us to get the best health insurance packages for small businesses.

It depends! The cost for small business health insurance varies depending on a number of factors, including –

- Employee age and gender

- Occupation

- Type of insurance coverage

- Health Conditions

Usually, small business owners in Houston can expect to pay at least $163 per employee for health insurance. We can tailor a health insurance package for your business.

It depends upon the health insurance company. Some health insurance companies require minimal documentation, but most will require your most recent TWC (Texas Workforce Commission) quarterly wage and tax statement for all employees.

- Recent payroll records

- Articles of incorporation, certificate of organization, or other organizational documents

- W-4’s for new W-2 employees.

- Coverage against medical and prescription drug expenses

- Tax benefits

- In-patient hospitalization expenses

- Lifetime renewability benefit

- Coverage for pre-existing conditions

Get a free benefits consultation.